(Written by William)

Recently, I’ve embarked on a new avenue of the LEGO hobby that I was, at first, intimidated by; selling LEGO. Selling LEGO sets and elements for a profit can be a risky proposition for those who don’t know the ins and outs of the hobby. After all, not every LEGO set is worth its weight in gold. However, this was not the part I was intimidated by. I knew what LEGO sets I had, and I had reasonable expectations of what I could get for them. What scared me was not being clear on the tax implications for selling in the U.S., and in my particular state. I did know the basics that selling LEGO – or anything else – and making money on these items does count as income, but I needed to clarify how all of that works. This is what we will look at today. Please note that I’m not a tax advisor or CPA, and what we will cover here is not legal or tax advise. If this topic is relevant to you, I would suggest you do your own research specific to your own situation and jurisdiction. So let’s begin (photo below by Jeff Gamble). 🙂

➡ LEGO & TAXES – ARE YOU A BUSINESS OR HOBBY SELLER?

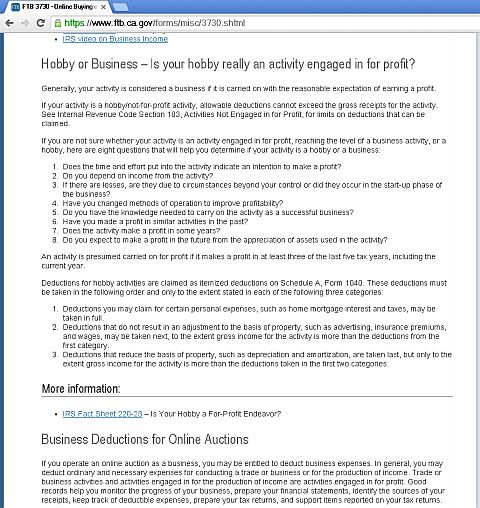

The first step is to figure out if you are selling LEGO as a business or as a hobby, because the IRS has specific rules and regulations for each category. If you are a business, there are a lot of resources you can draw upon, starting with the Franchise Tax Board (if you are in the U.S.), and your local state government. If you are just a hobby seller your profits are simply treated as earned income – which means it will get reported on your tax return at the end of the year. The question remains, how do you know which one you are? Thankfully the government gives us roughly eight questions to examine to see where we fall. In general, most people selling LEGO on the side won’t qualify as a business, but ideally you will ask a tax preparer or call the Franchise Tax Board for clarification in your particular situation.

- Does the time and effort put into the activity indicate an intention to make a profit?

- Do you depend on income from the activity?

- If there are losses, are they due to circumstances beyond your control or did they occur in the start-up phase of the business?

- Have you changed methods of operation to improve profitability?

- Do you have the knowledge needed to carry on the activity as a successful business?

- Have you made a profit in similar activities in the past?

- Does the activity make a profit in some years?

- Do you expect to make a profit in the future from the appreciation of assets used in the activity?

➡ LEGO & TAXES – SALES TAX

Whether you are a business or not, you are still responsible for collecting sales tax, under certain circumstances. In addition, you may need a seller’s permit to track your activity. Since rules can differ from state to state, I will use my home state of California as an example. Under California law, if I plan to make three or more sales in a calendar year, I’m considered to be engaged in business in the state. As such, I am required to go to the Board of Equalization (BOE) to attain a seller’s permit. The permit is free, but information is required.

Thankfully you can call in and get help from someone at the BOE. At the end of the process you will receive an account number and a schedule that will tell you when to turn in the sales tax you’ve collected. For me, I live in California, and that is where my “business” is conducted. Therefore, the state requires that I collect sales tax when I sell to anyone in California. And if a customer of mine also happens to be in my county or city, additional taxes may need to be collected, but anywhere else in the state I collect the base tax.

➡ LEGO & TAXES – WHAT GETS REPORTED?

Now that we’ve covered some of the basics, the big question is, what gets reported on your tax return? If you are selling as a business, you will follow basic business reporting rules. If you are a hobby seller, your hobby income is reported and deducted as itemized filing on your own personal tax return. Which means it will be a tedious process of reporting income and expenses. The other major factor is, are you really making an income?

First, are you calculating all the LEGO purchases you make in a year that you keep for yourself? Remember, if this is a hobby you have to look at the hobby as a whole. For most LEGO fans this means that at the end of the year you probably spent more on the hobby than what you made, and report it as a personal loss. Generally, reporting this on your taxes sends all kinds of red flags to the IRS.

Next, is the income you generate going straight back into the hobby? In this case it is more of a self-perpetuating hobby than any real income. Therefore, if you are the rare case where you are making a true income, it is most likely because you’re trying to start a business.

In terms of taxes, you probably should look into getting a seller’s permit. It helps your state, and everything is fairly easy to compute. As for the income generated from a side hobby, you may not realize that you are still working at a loss. Frankly, the government is more interested in what you can contribute rather than your ability to fill out forms in exquisite detail.

➡ LEGO & TAXES – A FEW EXTRA NOTES

I think it is safe to say, most people have no idea about taxes – this includes me. Typically, you need someone in your friends and family circles to make the process a lot less intimidating. While setting up my hobby store I never thought that collecting sales tax even applied to someone selling their personal property. But I found out that if you have more than one garage sale in California, you need a seller’s permit. If you plan to do something similar, I would suggest you check with your local jurisdiction about what is required.

I think a lot of the confusion stems from two major circumstances. The first is that government tax laws are really hard to read and understand for ordinary persons. I even found situations where terms were defined by using the same term in their definition, which is of course not helpful at all. The second factor is how easy it has become to sell stuff online. A lot of people who have no idea about the tax-implications of what they are doing are selling at places like eBay and Amazon without proper understanding – which can get them into trouble with the taxman.

Now this is not meant to scare you off from becoming a hobby seller, instead I hope this article at least starts you to ask the right questions and reach out to the right people to avoid any future troubles. It is always easier to keep records right from the start, then trying to backtrack later. And if you have any questions or comments on the subject, feel free to add them in the comment section below. It can turn into a helpful discussion. 🙂

And you might also like to check out the following related posts:

Funnily enough I did a similar exercise about 15 years ago in the UK when selling collectable card games (magic the gathering and Pokemon in my case). Even then the tax rules were so vague and hard to follow. Having to offset cost vs profit wilst as a student (so earning very little) but claiming it as a hobby (I was very seriously playing at the time) proved challenging. Especially if you lucked out and bought a bunch of stuff that then turned out to be worth a fortune (i guess a bit like picking up a UCS falcon at a car boot sale/garage sale for £10 etc)….

The rules are extremely vague probably to have something in place in case the issue becomes really important, but from the sound of it most issues are too small to bother with.

Although, they do seem to be a bit stricter when it comes to selling live stock as a hobby. Go figure.

Very interesting and timely article. One question. My understanding is that if I bought a set at a regular retailer and already paid sales-tax on it, when someone else buys it from me, they won’t have to pay sales-tax, as that would be double paying the tax. Only the first person purchasing the set retail have to pay sales tax. Is this correct?

Good question. I asked that when I was doing my research on this.

Turns out that the sales tax refers to the point of purchase not so much the item itself.

In essence an item that is sold 30 or even 40 times inside state limits will generate a new sales tax for each time it is purchased.

A good example of this is thrift stores. They charge sales tax provided there is no weird exemption they fall under. All the items were sold with a sales tax at some point before getting there, but they charge again because it is a new transaction.

Double taxation kicks in when one seller sells an item and tries to tax you for their state and yours. This is partly why you don’t charge out of state transactions sales tax since they are just happy that someone in their state is bringing in new money.

I hope that answered your question.

As long as PayPal doesn’t send out 1099 forms most people are probably safe.

Even if you don’t receive a 1099 form from PayPal, you are still required by federal law to report the income. If you don’t, you are committing tax fraud.

Too many people assume if you don’t receive a statement from some company, then you don’t have to do anything with it on your taxes.

To your point though, is the IRS likely to catch it? No. Are you required to report it? Yes

Starting in 2022, with reporting requirements now anything over $600, just one large LEGO set could trigger the form. Which makes this discussion more important than ever. I guess I will talk to the CPA.

Ed, yes, it’s best to discuss this with your tax advisor who knows all the ins and out of your personal situation.